Navigating the stock market during economic downturns can be challenging, as market volatility and uncertainty tend to increase. However, with the right strategies and mindset, it is possible to trade stocks successfully, even during economic turbulence.

This article will explore valuable insights and techniques for trading stocks during economic downturns, helping you make informed decisions and capitalise on potential opportunities.

Assessing market conditions and sentiment

During an economic downturn, it is crucial to closely monitor market conditions and sentiment. Understanding the overall economic landscape and the factors impacting the market can provide valuable insights into potential stock movements. Keep an eye on economic indicators, industry trends, and news that can impact the market.

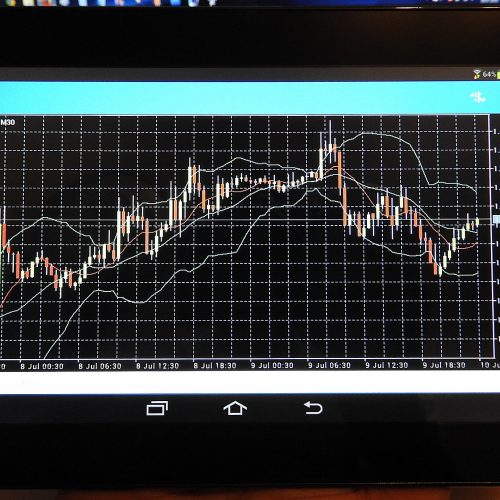

Investor sentiment also plays a significant role during economic downturns. Fear and uncertainty can drive market sell-offs, creating opportunities for traders. Monitoring market sentiment through indicators such as the Volatility Index (VIX) or investor sentiment surveys can help gauge the level of fear or optimism in the market.

By assessing market conditions and sentiment, you can better understand the broader market trends and make more informed trading decisions.

Focus on quality and defensive stocks

During economic downturns, focusing on quality and defensive stocks is prudent. These are stocks that are more resilient in challenging economic conditions. Companies with strong fundamentals, stable cash flows, and consistent performance history are better positioned to weather economic downturns.

Defensive sectors such as healthcare, consumer staples, and utilities often perform well during downturns. These sectors demand essential goods and services regardless of the economic environment. Focusing on stocks within defensive sectors can reduce downside risk and maintain a more stable portfolio.

Implement risk management strategies

Risk management is crucial when traders trade in US stocks or any other market, especially during economic downturns when market volatility can be heightened. Implementing risk management strategies can help protect your capital and mitigate potential losses.

One essential risk management technique is position sizing. Determine the appropriate amount of capital for each trade based on your risk tolerance and the specific trade’s risk-reward profile. Avoid allocating a significant portion of your portfolio to a single trade, as it can expose you to excessive risk.

Setting stop-loss orders is another essential risk management tool. A stop-loss order is a predetermined price at which you exit a trade to limit potential losses. By using stop-loss orders, you can protect yourself from significant downturns in individual stocks or the overall market.

Embrace volatility and seek opportunities

Economic downturns often increase market volatility, presenting opportunities for skilled traders. Volatility can create significant price movements, allowing traders to take advantage of short-term swings. Embrace volatility and adapt your trading strategy to suit the changing market conditions.

Consider incorporating strategies such as swing trading or day trading during economic downturns. These strategies capitalise on shorter-term price movements and can be effective in volatile markets. However, staying disciplined and adhering to your trading plan is crucial to avoid impulsive or emotional decision-making.

Identifying value opportunities

During economic downturns, stock prices can experience significant declines, creating potential value opportunities for investors. One effective strategy is identifying undervalued stocks with solid fundamentals temporarily affected by the economic downturn. These stocks offer attractive long-term growth potential once the market recovers.

To identify value opportunities, conduct a thorough fundamental analysis of individual companies. Look for companies with solid balance sheets, sustainable competitive advantages, and a history of generating consistent cash flows. Evaluate their industry positioning, competitive landscape, and management team to assess their ability to navigate challenging times.

To that end

Trading stocks during economic downturns requires a strategic approach and an understanding of market dynamics. By assessing market conditions and sentiment, focusing on quality and defensive stocks, implementing risk management strategies, and embracing volatility, traders can confidently navigate economic downturns.

Remember, patience and discipline are critical, and adapting your trading strategies to suit the prevailing market conditions is crucial. With proper preparation and a well-executed trading plan, trading stocks during economic downturns can present unique opportunities for success.