The world of trading has changed dramatically over the past few decades. With technological advancements, we now access more tools and resources. One of the most significant developments in this area is the rise of online trading platforms. No matter your industry or particular interests, these platforms can offer a range of powerful benefits that make it easier and faster to conduct trades and manage investments than ever. This article will explore these advantages in-depth by discussing the critical benefits of using an online forex trading platform.

Easier accessibility

One main advantage of online trading platforms is that they are far easier to access than traditional methods. Unlike physical exchanges, online trading platforms enable users to trade anytime or night from anywhere they have an internet connection. It eliminates the need for long trips to a stock exchange and reduces associated costs like travel expenses. A forex trader can also open a live or demo trading account to access the financial markets with real or virtual money, for different reasons. On top of this, trading platforms provide real-time pricing data on exchange rates and market analysis tools, making it significantly easier for traders to make informed decisions. Traders can also easily monitor their portfolios and make moves when right.

It makes copy trading possible

Another benefit of online forex trading platforms is that they make copy trading possible. Copy trading allows investors to automatically copy the trades of other investors with more experience in a particular market. It allows users to leverage the knowledge and expertise of experienced traders without engaging in complex research and analysis themselves. The most popular platforms for copy trading include MetaTrader 4 (MT4 download), which has a reputation for being one of the most comprehensive forex trading platforms to begin with. Copy trading with MT4 is one of the most popular tools online traders use due to its user-friendly interface and advanced features that make it easy to track signals from other traders and set up trading plans. It is best for new traders with limited market knowledge who are uncomfortable making their own decisions.

Lower transaction costs

The cost of transactions is another factor that makes online trading platforms so attractive. These platforms typically have lower fees than traditional stock exchanges and offer more competitive rates. It makes them an ideal option for traders looking to save money on trading fees. Many online platforms offer free demo accounts where users can practice trading strategies without risking their capital. It lets them get a feel for the platform before committing to trading with real money. Traders can also benefit from bonuses or promotions offered by online trading platforms, which can offer additional savings. It is best to carefully research these offers to ensure they are legitimate and come from reliable brokers.

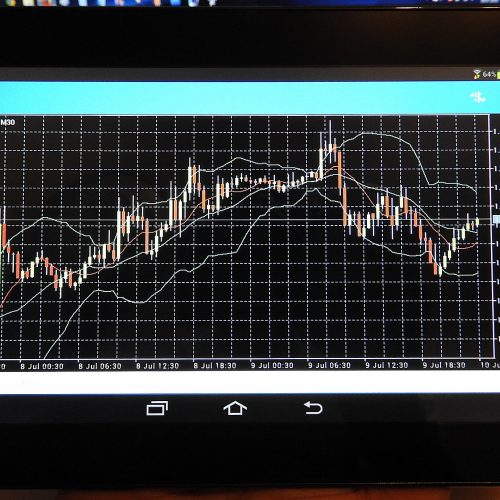

More advanced analytics tools

Online trading platforms also provide more advanced analytics tools than traditional stock exchanges. These tools make it easier for traders to track and analyse market data in real time, giving them a competitive advantage when making decisions about investments and trades. The most popular analytics tool online traders use is technical analysis, which involves studying historical price charts to predict future movement. Other tools available on online platforms include risk management and portfolio optimisation, which help traders manage their investments and reduce risk exposure. Traders can also access news and alerts on the platform to stay up-to-date with current market trends. It is best to use these tools in combination with fundamental analysis to make the most of trading opportunities.

Make use of automated trading

Online forex trading platforms offer the ability to make use of automated trading strategies. Automated trading systems allow users to set up a strategy that will automatically be executed when certain market conditions are met. It eliminates manual intervention and can help traders take advantage of opportunities even when they are not actively monitoring the markets. Automated trading systems also eliminate emotion from decision-making, making them ideal for investors looking to manage large portfolios without manually entering each trade. Forex traders can set up automated trading systems according to their preferences, allowing more flexibility and control over their trades.

Robust security

Online forex trading platforms provide robust security in the transaction process and in account management. Online platforms use advanced encryption technologies to protect user data and financial transactions from malicious attacks. They also have two-factor authentication measures to ensure only authorised users can access the platform. The added security can give traders peace of mind when making trades and managing their investments. Governments or international organisations regulate many online trading platforms, assuring investors that their funds are safe. Research a platform to ensure it meets the necessary standards for security and compliance before investing. Traders should also look for suspicious activity and report any unauthorised transactions immediately.