As a trader, one of the principal decisions is when to buy and sell forex. Making the incorrect decision can cost you dearly, so it’s essential to have a solid plan before trading. We’ll discuss some of the parts you should consider when making your trading decisions. We’ll also look at some simple strategies that you can use to help you make profitable trades.

What is forex trading, and how does it work?

Forex trading is the procedure of buying and selling foreign currencies. It is one of the largest markets in the world, with a daily turnover of more than $5 trillion. Currencies are traded instead of each other, and traders make money by correctly predicting how these pairs will move.

When to buy and sell forex?

The best time to purchase or sell a currency pair depends on several factors, including your risk tolerance, your investment goals, and the current market conditions.

If you’re new to forex trading, we recommend starting by trading during the busiest times of the day. It will allow you to see how different currency pairs move and learn how to read price charts. Once you’ve acquired some experience, you can start trading during off-peak hours.

When to buy?

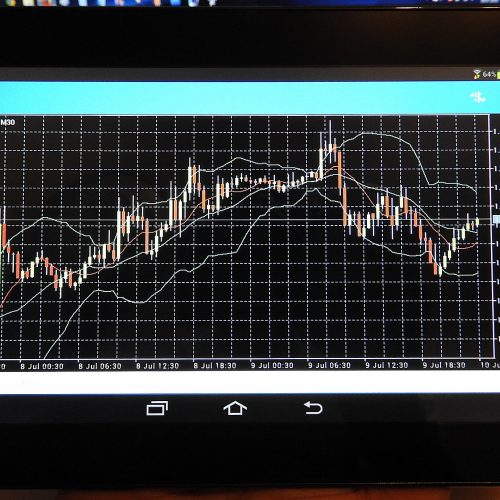

There are a few things you should take into account when deciding when to buy a currency pair. First, you’ll need to look at the current market conditions. Is the market trend bullish or bearish? If the trend is bullish, prices are rising, and you should look for opportunities to buy. If the trend is bearish, prices are falling, and you should look for opportunities to sell.

You’ll also require to consider your risk tolerance. How much money are you willing to lose on each trade? You shouldn’t put more than 2% of your account balance at risk on any single trade. If you have a $10,000 account, you shouldn’t lose more than $200 on any single trade.

Once you’ve considered these factors, you can start looking for opportunities to buy currency pairs. One process is to look for bullish price patterns on your charts. These patterns can indicate that prices are about to move higher.

Some common bullish price patterns include:

- Bullish engulfing pattern.

- Morning star pattern.

- Evening star pattern.

When to sell?

Like there are times when you should look to buy currency pairs, there are also times when you should look to sell them. Again, you’ll need to consider the current market conditions and risk tolerance. If the market is in a bearish trend and you’re comfortable with taking on more risk, you may look for opportunities to sell.

You can also look for bearish price patterns on your charts. These patterns can indicate that prices are about to move lower.

Some common bearish price patterns include:

- Bearish engulfing pattern.

- Evening star pattern.

- Morning star pattern.

The risks of trading forex and how to manage them

All forms of trading carry some risk. However, forex trading is considered one of the riskier markets to trade. Because currencies can be very volatile, and movements can be unpredictable.

There are a few things you can do to help manage the risks of forex trading.

First, you should never risk more money than you can afford to lose. It would help if you only traded with money you’re comfortable losing.

Second, you should always use stop-loss orders when entering into trades. A stop-loss order is an order that automatically closes your position if it reaches a certain level of loss. It helps limit your losses if the market moves against you.

Third, you should always take profits when they’re available. If you’re in a trade and the market moves in your favour, you should consider taking some profits off the table. It helps lock in some of your gains and limits your risk exposure.

Fourth, it would help if you diversified your portfolio. You shouldn’t lay all of your eggs in one basket. Instead, you should spread your money across several different trades and investments. This way, if one trade goes wrong, it won’t significantly impact your overall account balance.