The NFP report is released by the US Bureau of Labor Statistics every month and is one of the most closely watched economic indicators. It measures the number of jobs that have been created or lost in the previous month. The report can cause significant market volatility as traders react to the news.

Trading news releases

Because predicting the movement of a currency pair after its release can be hazardous, waiting for wild swings to die down is possible. Traders can try to take advantage of the market movement after the speculators have been eliminated or taken profits. This goal is to attempt to record sensible movement after the news instead of wild price fluctuations.

Trade the expectations for the report

There are several ways to trade around the NFP report. One way is to trade the expectations for the report. Traders will buy or sell stocks, currencies, or other assets based on whether they expect the report to be positive or negative. Another way to trade around the NFP report is to trade the reaction to the report. For example, if a trader expects a favourable report, they might buy stocks that are likely to benefit from a strong economy. Conversely, if a trader expects a negative report, they might sell stocks that are likely to be hurt by a weak economy.

Positive VS negative NFP report

The NFP report is one of the most important economic indicators released every month. A strong NFP report can boost stock prices and lead to a more bullish market. On the other hand, a weak NFP report can weigh stock prices and lead to a more bearish market. Traders should carefully watch the NFP report and be ready to trade around it.

Positive NFP report

A positive NFP report is generally seen as good news for the stock market. A strong economy usually leads to higher corporate profits and share prices. If you expect a positive NFP report, you might buy stocks that are likely to benefit from a strong economy.

Negative NFP report

A negative NFP report is generally seen as bad news for the stock market. A weak economy usually leads to lower corporate profits and share prices. If you expect a negative NFP report, you might sell stocks that are likely to be hurt by a weak economy.

The rules

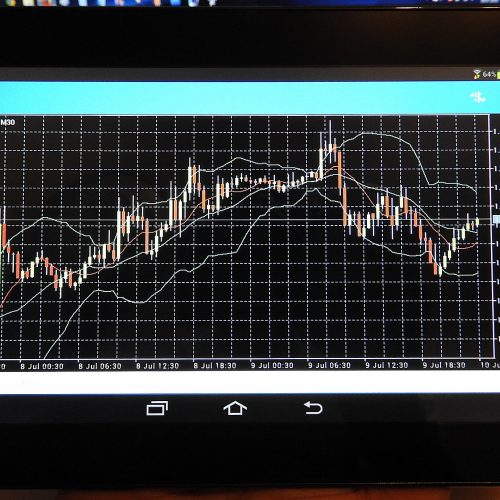

The trading strategy is available on either five- or 15-minute charts. Although the same guidelines apply to a five-minute chart, a 15-minute chart will be used for the following rules and examples. Signals may appear in different timeframes, so pick one or the other.

- Nothing occurs during the first bar following the NFP report (8:30 to 8:45 a.m. for the 15-minute chart).

- The opening bar will be extensive. Traders wait for an inside bar to appear after this first bar (it does not have to be the next one). In other words, they are waiting for the previous bar’s range to fit within the previous bar’s range entirely.

- The inside bar’s high and low rates set up our trade triggers. Market participants will take a trade in the breakout direction when a subsequent bar closes above or below the inside bar. They can enter a trade as soon as the bar passes the high or low without waiting for it to close, regardless of which method you use.

- Place a 30-pip stop-loss on the trade you just took.

- Make 2-3 deals. Don’t re-enter if both are unsuccessful. If a second trade is required, the high and low of the inside bar are reused.

- The majority of the move takes place within four hours after the report’s publication. Traders exit four hours after entry. If traders want to remain in the trade, they may use a trailing stop.

Lastly

The NFP report is one of the most important economic indicators released every month. A strong NFP report can boost stock prices and lead to a bullish market. A weak NFP report can weigh on stock prices and lead to a bearish market. Traders should watch the NFP report and be ready to trade around it.